Reguliertes Wertpapierinstitut. Depots und Verwahrstellen in Deutschland.

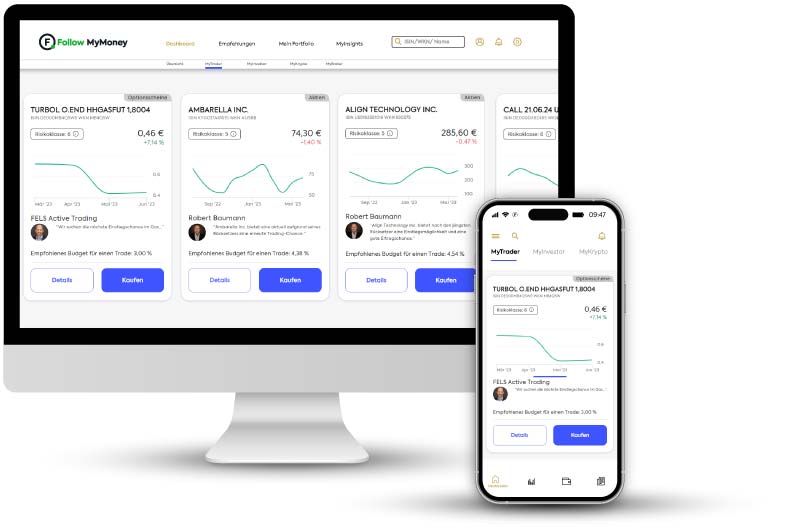

Die Digitale Vermögensverwaltung für fortgeschrittene Anleger durch echte Anlage-Profis und Trading-Spezialisten

Die Digitale Vermögensverwaltung für fortgeschrittene Anleger durch echte Anlage-Profis und Trading-Spezialisten.

Keine Vermögensverwaltung von der Stange

– Aktives cleveres Vermögensmanagement ohne Aufwand

Seien Sie mit dabei, wenn andere kräftig Geld verdienen und Profis smarte Anlage-Entscheidungen treffen – ob konservative Strategien zur Vermögenserhaltung oder aggressive Wachstumsstrategien zum Vermögensaufbau individuell zusammengebaut aus Assetklassen auf die auch FamilyOffices setzen würden.

…wie Sie wünschen!

Bei der Vermögensanlage geht es für Sie um mehr als um Ihr Geld: Es sind Ihre Ziele, die im Mittelpunkt stehen, und Ihre Erwartungen für sich und Ihre Familie! FollowMyMoney unterstützt Sie auf dem Weg, die Wünsche, die Sie antreiben, Wirklichkeit werden zu lassen:

Schutzschild gegen Vermögensfresser

Inflation und die Zeit arbeiten bei Ihrem Vermögensaufbau gegen Sie. Lassen Sie sich nicht stressen! FollowMyMoney unterstützt Sie beim Aufbau und der Absicherung Ihres Wohlstandes, auch wenn die Märkte verrücktspielen – mit fairen Konditionen und Experten, an denen Sie sich orientieren können. Ein großes Universum von Geldanlagen liegt in Ihrer Hand.

Was unsere Kunden über uns sagen

Unsere Partner

Bekannt aus dem Forbes Magazin